Peer-to-peer Lending Reviews and Analysis 2022

Review and determine the reliability of various Peer to peer and Crowdfunding platforms with Sneakypeer Scoring to earn Your way to financial freedom.

P2P Reviews

Sneakypeer has analysed more than 60 platforms for you

Statistics

Make investments based on company historical performance

Insights

Receive real-time updates about the changes at your platform

Sneakypeer Top Rated P2P Platforms

About Peer to Peer Lending

What is Sneakypeer?

Sneakypeer scoring is an independent and objective scoring system that evaluates P2P Lending and crowdfunding platforms, serving as a risk indicator of such platforms. We analyze data on the basis of information about the company, its revenues, finances, functionality, board\owners, ect. On top of that we offer all kinds of information about each platform, aggregating information, giving investors the opportunity to rate a platform and providing financial data.

We do this because…

Any investment instrument is safer if the investor is properly informed and trained. Money loves the smart ones.

Let's brag a little

As we have already explained – we are not an ordinary company. Sneakypeer solves a problem of information getting out of date extremely fast. We have developed the functionality that allows platform representatives to amend the information themselves and update it at any time. This doesn’t apply to our scoring, the calculation of which is based on the information available in the system. It is only after directly communicating with us that platforms can increase their score if the questions are responded, information is provided and improvements are implemented.

Why does it work?

We are aware of a major contemporary problem – no one has plenty of time. That’s why we provide clearly comprehensible information and save our customers' time by offering reliable results.

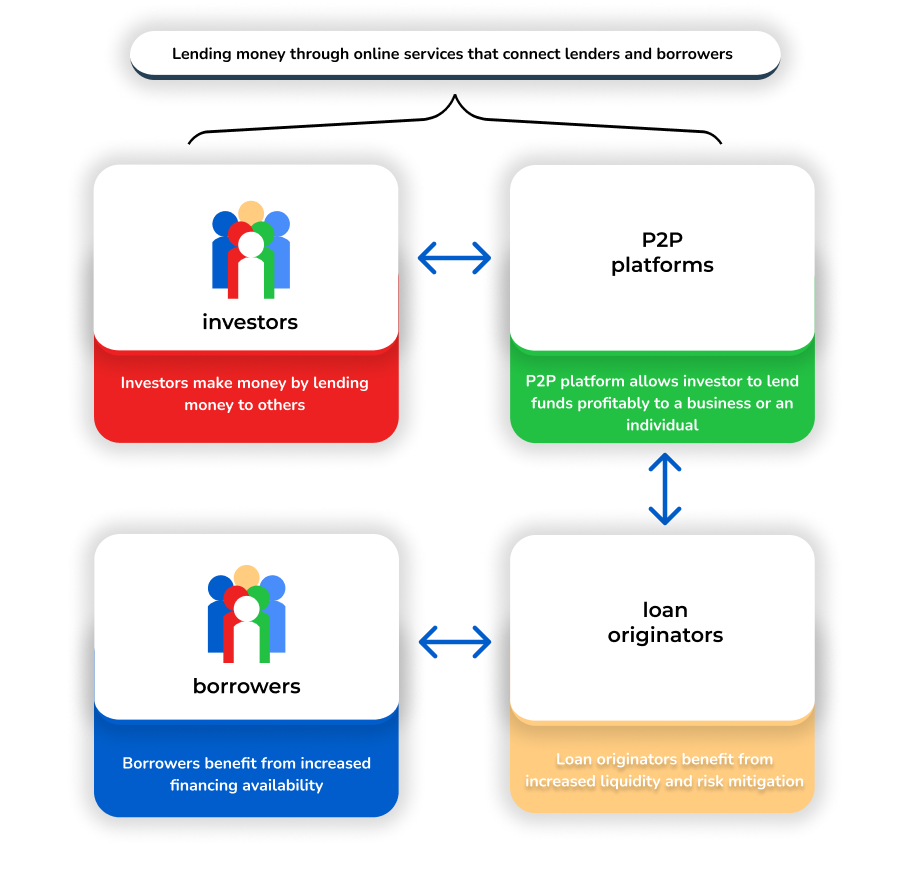

How Peer to Peer lending works?

Is it safe to invest in Peer to Peer lending?

2) Bankruptcy of a loan originator that lists loans on a platform;

3) Default of a borrower that has indirectly borrowed funds from you.

P2P VS equity investing: Which one is the right choice?

P2P

P2P is a peer-to-peer network that is based on equality of partners. However, the P2P format poses certain risks:

■ Reliability of the bidder with whom the contract is awarded;

■ Robustness of the platform itself, where the borrowing takes place;

■ Exchange rate volatility risk.

Equities

The risks in equity investing are of a different nature:

● Market valuation. Stocks can rise and fall in value. The higher are the fluctuations in the value of the securities, the higher are the risks.

● Liquidity. It is not always certain that the securities will be of interest in the market and can be sold at a good price.

● The strategy and reliability of the broker. It is difficult for a novice investor to choose a profitable strategy, and entrusting all capital to an unfamiliar broker is equally dangerous.

● The business reputation of the issuing company. The equity value of a stock is directly dependent on the reputation of the company itself. But as we know, general economic turbulence and unfair competition can play havoc with companies and investors.

Benefits

P2P investors make good profits by lending money at interest. It is essential to work out the details of a contract with a reliable partner on favorable terms. Participants communicate directly without intermediaries, and nothing will jeopardize your investment on a solid platform. Investing in equities on stock exchanges usually does not result in as high returns as on P2P platforms, and positive results can take a long time to materialize. But if you choose a portfolio diversification strategy, you don't have to feel anxious about losing all your investments. To sum up, it is worth noting that the choice between equities or P2P depends on the investment objectives and the timing of the return. Sneakypeer provides its own assessment of the reliability of P2P platforms, as our mission is to make this market transparent and profitable for all participants.

Data-Driven And Informed Decisions

By leveraging pure data, multi-layered mathematical risk-assessment models, and academic research, our team has built an all-in-one, automated platform for investors of any experience level to help diversify and expand their investment portfolio with peer-to-peer loans. Save time, energy, and efforts - start making informed, data-driven decisions with Sneakypeer today.