Table of contents

Introduction

What is P2P lending?

How profits are made?

What if a borrower doesn't pay back?

What other risks investors should be aware of?

Where should I invest and how much?

What to do when investment is made, what to expect?

Conclusion

Introduction

Nowadays, the majority of people seek the state of financial well-being known as "financial freedom," and it has become clear that investing is one way to achieve it. P2P investing has grown in popularity over the last decade among those looking to invest in their future and generate passive income. But what exactly is peer-to-peer lending?

What is P2P lending?

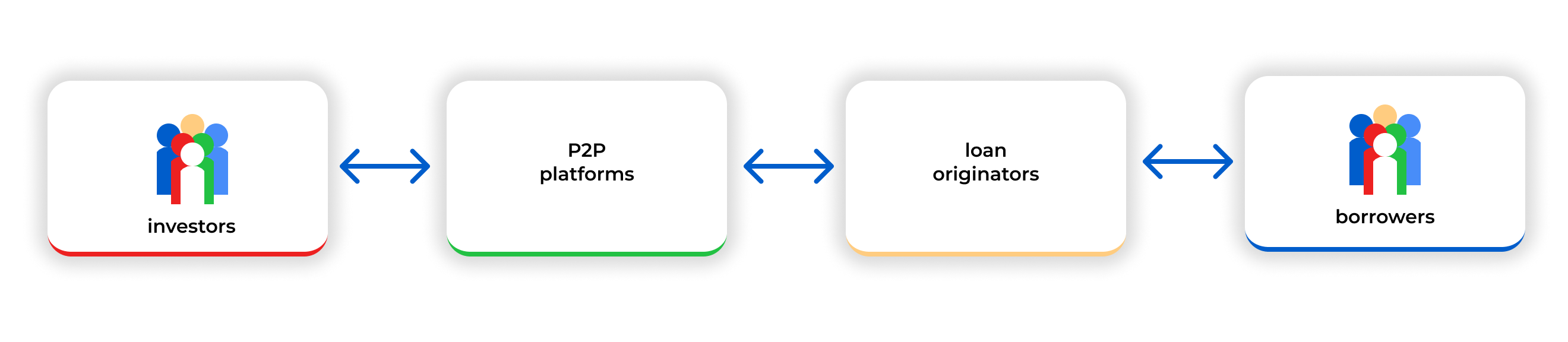

Peer to peer lending (also know as P2P Kredite) is self-explanatory, implying that a process moves from one person to another, which it does. P2P lending is a system that allows people to lend money to others without going through a bank. The middleman is a Peer-to-Peer platform that provides a technical solution and monitors transactions between both parties: a borrower and a peer to peer lender.

This is known as traditional P2P lending, and it was more popular in the industry's early stages. Since then, business models have evolved and split throughout history. There are still platforms that use the traditional P2P lending business model, but the vast majority have switched to a model known as marketplace lending.

An individual investor can acquire or purchase an already issued loan through marketplace lending. This significantly expedites the process and increases the loan supply for potential investors. So, in essence, P2P lending allows an investor to purchase loans that have already been issued by a third party company known as a loan originator.

The P2P platform acts as a go-between for investors and loan originators. Most platforms, such as Mintos, have more than one loan originator partnership Twino, for example, is one of the few platforms that only offers loans originated by their group company loan originators.

The P2P industry has expanded in terms of products available. Loans to private individuals are not the only investments available to an investor; investments in collateral backed mortgages, student loans, invoice financing, small business loans, for example, are also available.

Nonetheless, while these business models can be complicated, and the variety of products available can be confusing to a potential investor, the main functionality remains clear—offering an opportunity for everyone to invest in loans.

How profits are made?

Some may wonder, "How can I profit from investments in p2p loans?" Borrowers pay for the entire industry. Consider the following very simple example:

The borrower receives a 1000 EUR loan for one year at 30% interest, which means that it must repay 1300 EUR.

This loan is made by a loan originator as a financial institution using their own money. The company requires a quick increase in loan issuance, but 1300 EUR is locked in for a year.

Here comes peer-to-peer lending. The loan originator lists claims on this loan for sale on a P2P lending platform, promising an investor 12 percent per year. P2P platforms provide the necessary technology for such processes while taking a 3% cut.

An investor pays 1000 EUR for a loan and waits one year. At the same time, the loan originator receives 1000 EUR, which can be distributed to new clients. It is beneficial for all parties involved.

If a borrower repays and everything goes smoothly, investors receive 1120 EUR after a year, 1000 EUR principal + 120 EUR interest, while the loan originator receives 150 EUR = 180 EUR – 30 EUR (fee to the platform).

What if a borrower doesn't pay back?

This could be the case, and an investor now owns a loan. It means that risks are transferred from the lender to the investor, but the majority of lenders offer a buyback guarantee. They guarantee that if a payment is late (usually 30, 60, or 90 days), they will pay back principal and interest to the investor, thereby purchasing the non-performing loan and dealing with a non-paying borrower themselves.

While a buyback guarantee sounds appealing, investors should also consider the ability of loan originators to buy back a loan. Loan origination would not have enough funds to buy back all of the loans in the event of thousands of late monthly payments. Nothing is guaranteed, that is for certain.

What other risks investors should be aware of?

It is important to remember that the P2P lending model has three main elements: borrowers, loan originators, and P2P platforms. Each one entails a unique set of risks. The first one was discussed already. While the potential failure to buy back a loan has already been mentioned, loan originators face additional risks.

Even if an individual loan performs well, loan originators, like any other business, can declare bankruptcy. In the case of a loan originator's insolvency, an extended period of time is required to receive back invested funds.

When a P2P lending platform advertises and onboards a loan originator, it should do its own due diligence to ensure that the loan originator has sufficient financial resources. Unfortunately, even P2P platforms are not without risk, and some may even be scam projects that offer non-existent loans and false loan originators on their website. This has been the case in the past.

Tools like Sneakypeer, which are designed to alleviate dangers connected with P2P platforms, might be useful, but each investor should conduct their own research and ensure that the site they choose is safe.

Where should I invest and how much?

We would recommend a few extra steps after an investor has done their own research and chosen the best P2P platform.

Loan availability and cash drag.

Research on loan availability on the selected platform should be performed. The selected investment amount might be higher than loan availability on the platform. This might be the case more often if an investor chooses to maximise diversification by investing a minimum amount of funds in a maximum number of loans. Cash drag can occur as a result of a lack of research into loan availability on a platform.

A cash drag is a portion of a portfolio that cannot be invested and generates no profits. It could be caused by a limited loan supply. The logical next step should be to withdraw funds that have not been invested, but few platforms charge withdrawal fees.

This situation can result in a percentage of the portfolio being lost due to a single error. Losing money in P2P lending is easier than it appears.

The offered loan terms, guarantees and features.

Guarantees and other risk mitigation tools offered by each P2P lending platform vary, as do the characteristics of available loans, fees, and other factors. Crowdfunding platforms such as EstateGuru should be considered if an investor feels financially secure and is willing to invest for the long term.

Asset liquidity should be carefully considered. If an investor decides to liquidate their portfolio due to financial difficulties or another need for funds, it may take months to withdraw all funds from a P2P platform. This is why the loan terms of available loans must be considered.

P2P lending platforms also provide a secondary market feature, which allows investors to liquidate their assets more quickly by selling them to other investors at a discount of their choosing.

If the goal is to invest 10,000 EUR and diversify the funds as much as possible, it would take approximately 1,000 manual investments and a few thousand mouse clicks. Because not everyone has the time or patience to do it, P2P platforms provide auto-invest tools that invest funds automatically based on the preferences of investors.

It should be noted that the autoinvest feature is only available to sophisticated investors on some platforms. A platform will typically ask an investor to complete a questionnaire or test to determine whether or not the investor is professional. Before depositing large sums of money, each investor should ensure that autoinvest is available after completing the full registration process.

Sum it up

Before making a decision, investors should investigate a P2P platform's loan availability, available tools, fees, and risk mitigation mechanisms. But there's one more thing: this should be repeated for each platform. It is not advised to invest all funds in a single peer-to-peer platform. Investments should be spread across multiple Peer-to-Peer platforms, not just among different loan originators and loans.

What to do when investment is made, what to expect?

Investing in initial capital is only the beginning. Few loans will most likely be bought back before the end of the initial repayment period. Few loans will be repaid late. Some loans will be paid off early, leaving you with no profit because that is how the math works.

Unless the tool is turned off, Auto Invests will automatically reinvest profits and principal repayments in new loans.

Reinvestment risk

In terms of reinvestment, it is only natural for an investor to want to continue the process and reinvest profits. Reinvestment risk should be considered in this case.

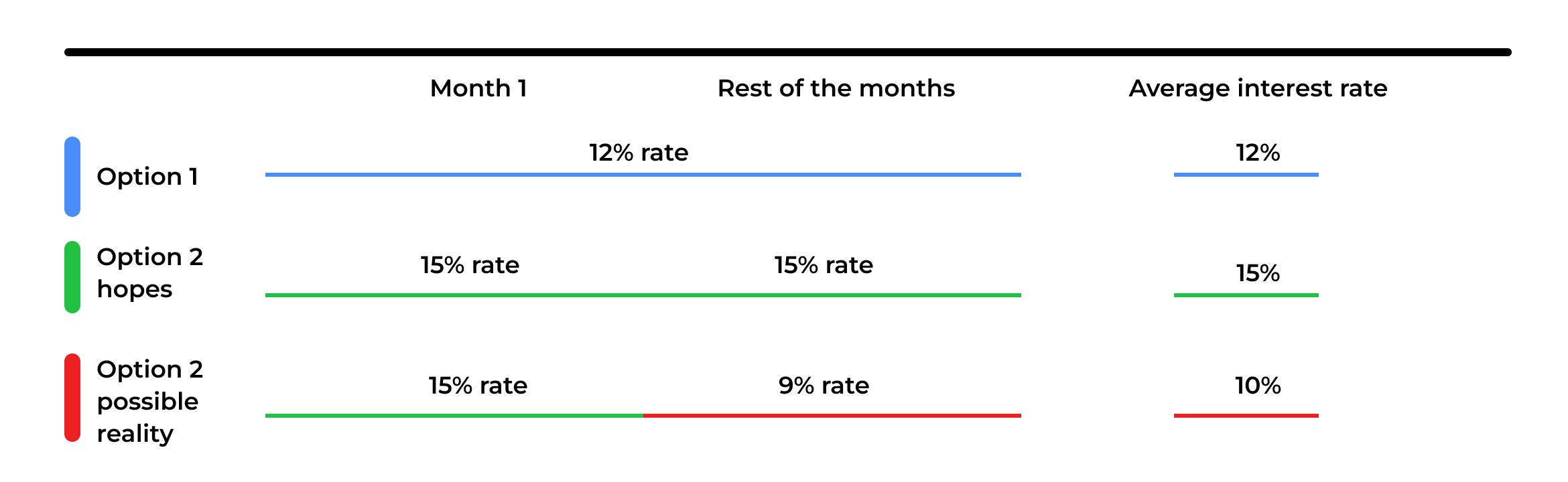

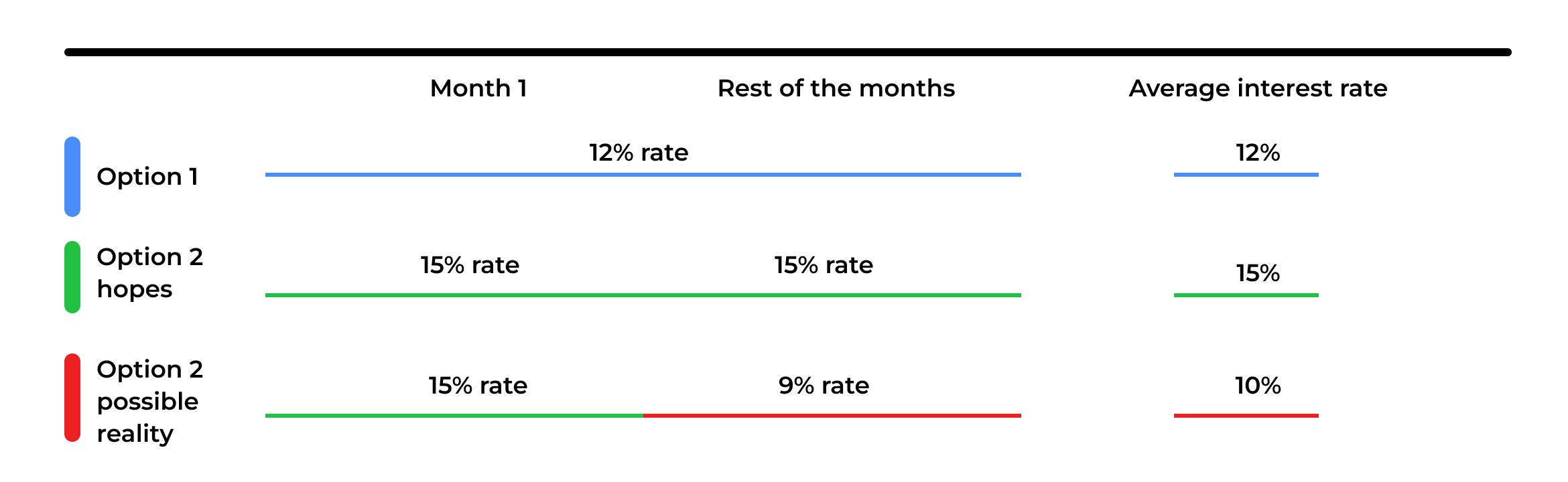

Which of the following loans would be more appealing to an investor: the first (1 year term, 12% promised return), or the second (1 month term, 15% promised return)? It could be the second option because it offers a higher interest rate.

An investor could simply take the second loan, receive profits after one month, reinvest them, and repeat this process throughout the year. Unfortunately, for the rest of the year, the best loan available on the market may only have a 9 percent guaranteed return after a month. It means that choosing the first loan was ultimately more profitable. This is referred to as "reinvestment risk."

Returns

It is simply promised or advertised in terms of a promised return. Real returns will vary and will most likely be significantly lower for investors. It is caused primarily by loan repayment schedule deviations and other factors. It would be beneficial to read about other investors' actual returns experiences.

The average advertised return of available investment opportunities is calculated by the majority of platforms. It would be unwise to base future expectations on these figures.

Risk should be considered in order to estimate a more accurate return expectation. Few platforms provide both historical loan default probabilities and recovery percentages. These parameters allow us to make more accurate profit estimates. If the default probability is 5%, it is assumed that 5% of the portfolio will default. When a loan defaults, it goes through a recovery process in which the goal is to recover as much money as possible. The proportion of non-covered loans is known as Loss Given Default. Let us suppose it is 40%. We assume that both parameters have a time frame of one year. Here's an example:

The promised return is 12%, and the investment amount is 10,000 EUR. Taking LgD (Loss Given Default) and PD (Probability of Default) into account, 300 EUR will be lost in one year (10'000 x LgD x PD). This means that instead of 1200 EUR, the profit will be 900 EUR (1200 - 300). It allows us to conclude that the risk-adjusted return on investment is 9 percent rather than the promised 12 percent.

When it comes to crowdfunding, keep in mind that funds will take time to generate actual profits. When an investment in offered loans or projects is completed, it usually takes some time for the project to reach the required funding amount. There may be instances where this funding amount is not met, and investors receive their funds back with no profit.

Conclusion

Investors would benefit from close monitoring of selected platforms in the event of P2P platform declines, allowing them to detect potential red flags early and withdraw funds. A number of scam platforms, for example, removed all board members from the board a few weeks before the execution of a scam.

The allocation of funds is only the beginning of P2P investing.