How P2P lending differs from traditional financing

Table of Content

What is Traditional Financing?

How does P2P Lending Differ from Traditional Financing?

Why is P2P lending better than traditional financing?

Introduction

Peer-to-Peer lending, or P2P lending, is a fast-growing lending market that is challenging established lenders, such as banks. What exactly is it?

Instead of borrowing from a large entity like a bank, "Peer to Peer" lending lets you borrow money directly from other people. However, even though P2P Lending platforms have their own set of laws and processes for loan approval, they are generally more forgiving as well as simpler than traditional banks.

What is P2P lending?

Individuals and businesses can borrow money directly from each other through peer-to-peer lending. The majority of P2P lending is done via online platforms that connect lenders with potential borrowers and facilitate the lending process.

Secured or unsecured loans are both available through peer-to-peer lending platforms. P2P lending, on the other hand, consists primarily of unsecured personal loans. Loans backed by luxury products are extremely rare in the industry. Peer-to-peer lending is regarded as an alternate source of finance because of its distinct properties.

What is Traditional Financing?

When we talk about "traditional" finance, we're talking about a loan or line of credit that is secured by a financial institution and is subject to standard requirements, like the "four Cs":

-

character,

-

collateral,

-

capital,

-

capacity.

Lenders use your credit history, your company strategy and your assets to determine if you're eligible for this type of funding.

Loans from major or local banks are the most popular form of traditional finance. When applying for a loan from a large bank, you may find that the approval procedure is mainly reliant on inflexible numerical parameters like your credit score. Smaller banks may charge higher interest rates, but they are more likely to offer the application careful consideration and work to find a solution to obtain a loan.

How does P2P Lending Differ from Traditional Financing?

The following are the most significant distinctions between a traditional financing and a peer-to-peer lender:

Rates of Interest

P2P lenders are typically able to offer lower returns than traditional banks because of their lower overhead. This is due to the fact that the vast majority of P2P lenders are merely linked to a P2P platform, via which lenders sanction loans and collect their revenues. The most common examples being Twino, Swaper and ViaInvest. P2P lending does not have a traditional brick-and-mortar structure. Banks, on the other hand, have a large number of expenses, including personnel pay. As a result, they are required to maintain slightly higher interest rates.

Convenience

In peer-to-peer lending, an applicant can request a loan online, provide the required paperwork to a person who will come to their location to collect them, and then get the funds in their bank account or other financial institution. As a result, it is really simple and straightforward in this system.

In traditional lending, one must physically visit a bank and submit applications, documentation, and other materials. In addition, the disbursement time is typically lengthier than with peer-to-peer lending.

It's not difficult to understand why peer-to-peer lending is becoming increasingly popular. However, this does not negate the fact that banks have their benefits. Given their larger size, they can provide a greater selection of financial tools as well as other types of benefits.

Process of Obtaining a Loan

When compared to traditional banks, the loan permitting process within P2P lending is much less complicated. Several peer-to-peer lending sites provide loans to borrowers with poor credit histories. A traditional lender, on the other hand, is usually never going to overlook something like this.

Why is P2P lending better than traditional financing?

In contrast to bank CDs, private lenders might earn yields several percentage points more than those offered by a bank or credit union.

Many people prefer to know who they're giving loans and why they're requesting them. In addition to providing a sense of accomplishment, they can also select borrowers who they feel will be able to return the loan on time and in full.

To borrow money, there is a charitable component. If a prospective borrower has a questionable credit history but a compelling narrative to tell, the lender may be ready to take on more risk in exchange for a lower return in funding the loan.

At a P2P lending platform, there can be a real sense of community. Users are ready to share their lending as well as borrowing experiences on forums where the community is active. Debate is raging over the P2P lender's proposed policy modifications.

For some people, banks are the bane of their existence, and they'll stop at nothing to avoid them.

Why is P2P lending not good?

Due to poor credit, many applicants are not eligible for loans.

Lenders are exposed to defaults, and their money is not guaranteed (with limited exceptions). There is a wide range of success among P2P lenders in limiting the amount of money they lose on a given loan. A compelling sob tale can persuade a lender to make a bad loan.

With P2P lending, there is a lot more labour involved, especially when the loans are paid through an auction. Financial acumen is required for the loan choice and bidding procedure, which many people lack.

There are certain advantages to lending money, but it's not guaranteed that the returns would be greater than on a traded index fund, which requires minimal effort to acquire and keep over time.

If you don't want to share your financial details with the world, a large impersonal bank may be the best option for you.

Lender consolidation, administrative reforms, and modifications to lending standards are all likely in this nascent business, given how young it is. Disciplined investors may not be willing to accept this level of risk and burden.

|

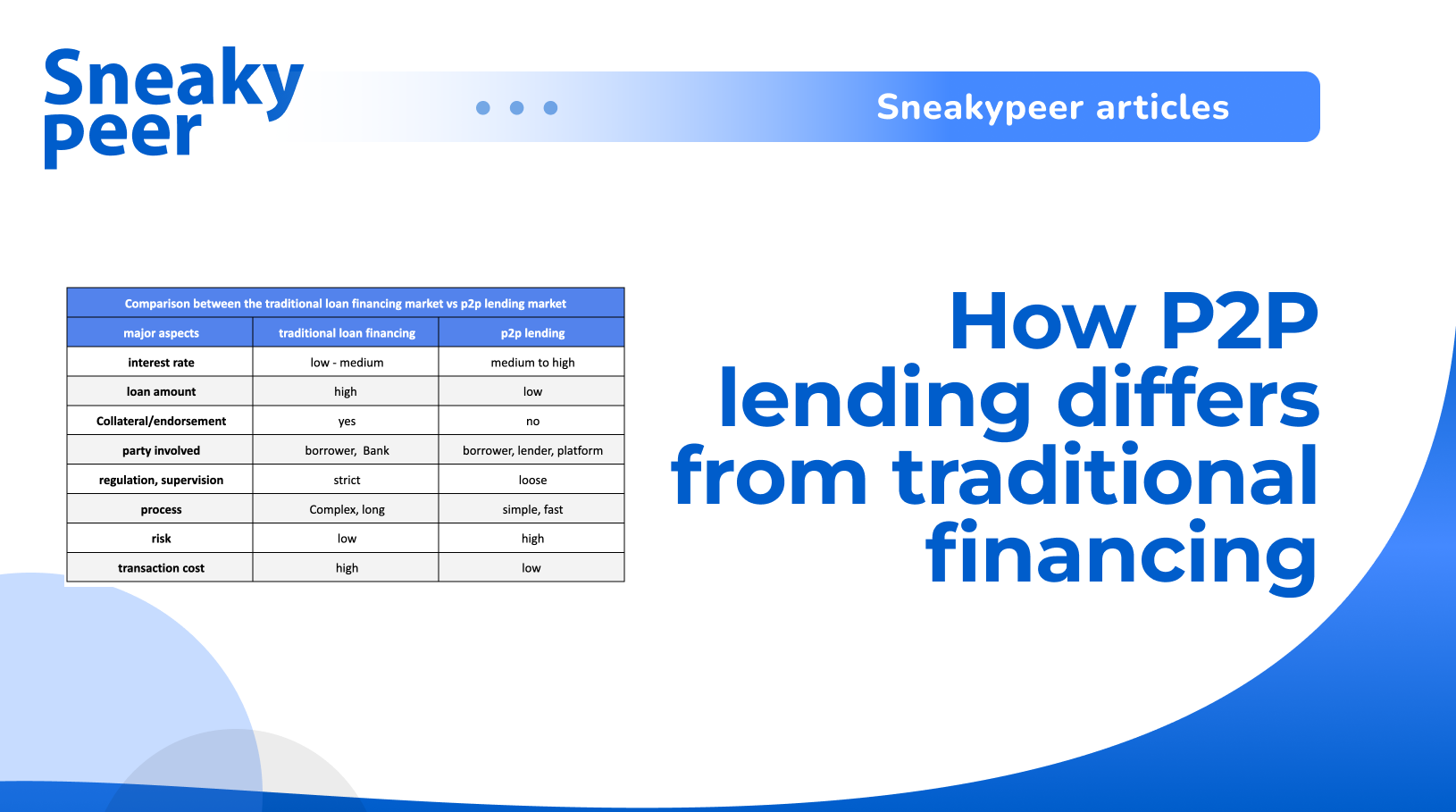

Comparison between the traditional loan financing market vs p2p lending market |

||

|

major aspects |

traditional loan financing |

p2p lending |

|

interest rate |

low - medium |

medium to high |

|

loan amount |

high |

low |

|

Collateral/endorsement |

yes |

no |

|

party involved |

borrower, Bank |

borrower, lender, platform |

|

regulation, supervision |

strict |

loose |

|

process |

Complex, long |

simple, fast |

|

risk |

low |

high |

|

transaction cost |

high |

low |

Conclusion

The loan offered to the borrower is perhaps the most significant distinction between p2p lending and traditional institutions. Using an internet platform, an individual, group, or institution can lend money to another person. For those whose money originates from a financial institution such as a bank or credit union, this is referred to as a bank loan.

As a general rule, traditional bank loans are now in the case of consumer loans such as auto and school loans, while peer-to-peer loans can be used for anything from small business acquisitions to large purchases such as real estate. Bank loans are a wonderful option for customers with good credit because of the low-interest rates.

It's not uncommon for the peer to peer lending system to have higher interest rates than the banking system. When comparing APRs, p2p lending loans can have APRs as high as 10-14 %, where as bank loans can have APRs as low as 7%.