How p2p lending differs from crowdfunding

Table of Content

How does P2P Lending Differ from Crowdfunding?

Which of the following options should you select?

Introduction

Crowdfunding and P2P lending have become popular funding options for small businesses in the last decade or so.

When it comes to receiving money from others, crowdfunding and peer-to-peer lending both have a lot of similarities and a lot of differences. So Crowdfunding may be a better option for your company than Peer to peer lending or the other way around.

Whatever the case may be, we're here to assist you. We'll explain the differences between them and how to choose the best one for you.

P2P lending and Crowdfunding

To begin, what are peer-to-peer lending and crowdfunding? When it comes to small business funding alternatives, it's important to get everyone on the same page.

What is crowdfunding?

By using a method known as "crowdfunding," you can raise money from a large number of individuals at once. These people are usually compensated in some way by those people.

For the sake of convenience, a wide range of crowdfunding platforms is available. Popular crowdfunding platforms like Estateguru, and Raizers are certainly familiar names to you by now. The good news is that you can find crowdfunding platforms to suit just about every need.

There are many other sorts of crowdfunding in addition to the many platforms. Crowdfunding is typically classified according to how the money raised will be used.

That's reward crowdfunding if you're giving backers things like merchandise or notoriety. Then there's "equity crowdfunding," where funders get a stake in your firm (essentially a percentage of ownership).

In general, reward crowdfunding is better suited to individual items and initiatives, whereas equity crowdfunding is better suited to an entire company.

What is peer to peer lending?

Rather than traditional banks, private investors are providing money to small businesses in the form of peer-to-peer lending.

A company loan or a line of credit is typically the shape that peer-to-peer financing takes. Furthermore, even if private investors provide the funding, they often do it via p2p lending platforms. Often, such platforms pool together capital from several P2P investors to lend money to small and medium-sized enterprises.

P2P lending systems have made it so that most of the time, the borrower and investor never have to speak. Lending platforms serve as a go-between for borrowers and lenders. As a result, the borrower uses the platform to apply for a loan, receive funding, and make payments on time.

Since P2P lenders typically have lower borrower requirements, small business owners frequently choose P2P lending over traditional lending as a financing option. While P2P lenders frequently provide lower returns than other types of lenders, this isn't always the case.

As a result, P2P lending services serve as an intermediary between traditional financial institutions and short-term internet lenders.

How does P2P Lending Differ from Crowdfunding?

In the minds of many people, crowdfunding, as well as peer-to-peer lending, are the same, yet there is a significant difference between the two. In both cases, a group of people band together to raise money for a common cause. However, they're two quite distinct choices.

However, crowdfunding offers several advantages, including the option to borrow payments without having to pay back the money. It's very uncommon for businesses who perform well enough on crowdfunding sites to offer unique and fascinating products for sale. Making a successful marketing campaign for a product is far simpler than doing so for a service. The majority of folks want something new and different. Trying to raise money for a product that can be found in a store is unlikely to succeed.

In contrast to crowdfunding, a Peer to peer loan can be received by any firm, regardless of its type. If you're selling something, you may qualify. That's because Peer to peer lending is focused on personal and corporate history, not about how flashy the firm is or how well you can advertise it. For start-up enterprises, this implies that P2P lending is not quite as productive as it could otherwise be.

P2P loans can be tough to come by for firms with bad credit. In the absence of sufficient revenue or credit, you will be unable to persuade a lender. If nothing else, crowdfunding offers the chance to persuade the audience to back you and your project. Peer-to-peer lending, on the other hand, is more accessible to many firms than crowdfunding.

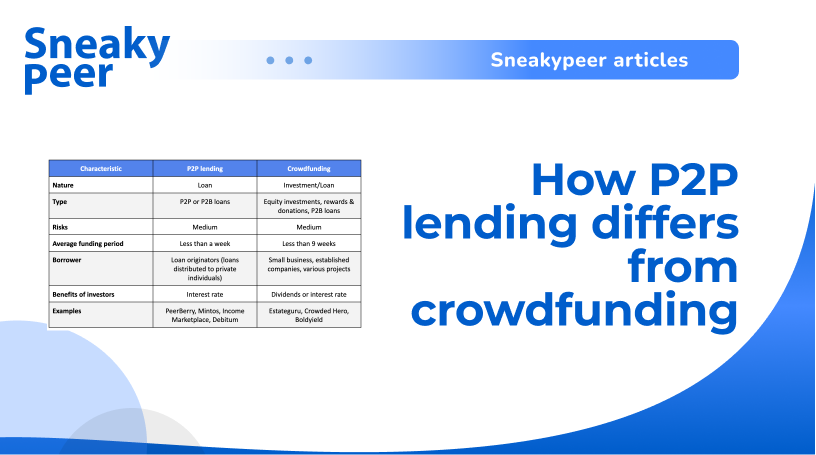

|

Characteristic |

P2P lending |

Crowdfunding |

|

Nature |

Loan |

Investment/Loan |

|

Type |

P2P or P2B loans |

Equity investments, rewards & donations, P2B loans |

|

Risks |

Medium |

Medium |

|

Average funding period |

Less than a week |

Less than 9 weeks |

|

Borrower |

Loan originators (loans distributed to private individuals) |

Small business, established companies, various projects |

|

Benefits of investors |

Interest rate |

Dividends or interest rate |

|

Examples |

Which of the following options should you select?

Investors may make the best decision for their needs if they understand the mechanics of both types of investing. Understanding the mechanics of every method of investing allows the investors to decide what is best for their needs. As an entrepreneur, you must take advantage of the financing possibilities that are most advantageous to your company's operations. You should think about the fundamental aspects of your business, such as whether you are selling a product or a service, which markets you plan to pursue, or whether or not capital is necessary in this case in your business's development. In any case, the availability of a variety of alternative and relatively low-risk financing techniques such as peer-to-peer lending or crowdfunding are options that should be seriously considered.

Conclusion

Financing your small business can be as simple as using crowdsourcing or peer-to-peer lending. Although they both allow you to raise money from investors, the two systems operate rather differently.

Crowdfunding is most effective for product-based enterprises because of its campaign-based structure. In contrast, service-based enterprises and others can benefit from P2P lending if they can achieve the basic borrower standards.